- Corporate Law and M&A

- Code Buysse , a guideline for good corporate governance in non-listed companies , corporate governance code , corporate governance , recommendations on how to govern a company in a proper manner , directors' liability , efficient, effective, and future-oriented management , diversity within the board , the importance of succession planning , a long-term vision

The Code Buysse has served as a guideline for good corporate governance in non-listed companies since 2005.

Recently, a new version of the Code Buysse was introduced.

In this article, we analyze the content and legal value of this corporate governance code.

1. What is the Code Buysse?

Following several accounting scandals in the United States and Europe, a trend emerged in the early 2000s to regulate good corporate governance. This led to the introduction of a corporate governance law in Belgium in 2002, a corporate governance code for listed companies in 2004 (known as 'Code Lippens’), and a corporate governance code for non-listed companies in 2005 (known as 'Code Buysse’). Unlike the corporate governance law, the corporate governance codes are not legally binding but a set of recommendations on how to govern a company in a proper manner.

Just like the corporate governance code for listed companies, the Code Buysse is regularly updated as well. On December 3, 2024, the Code Buysse IV was introduced.

The latest version can be downloaded from the Code Buysse website.

2. Legal value

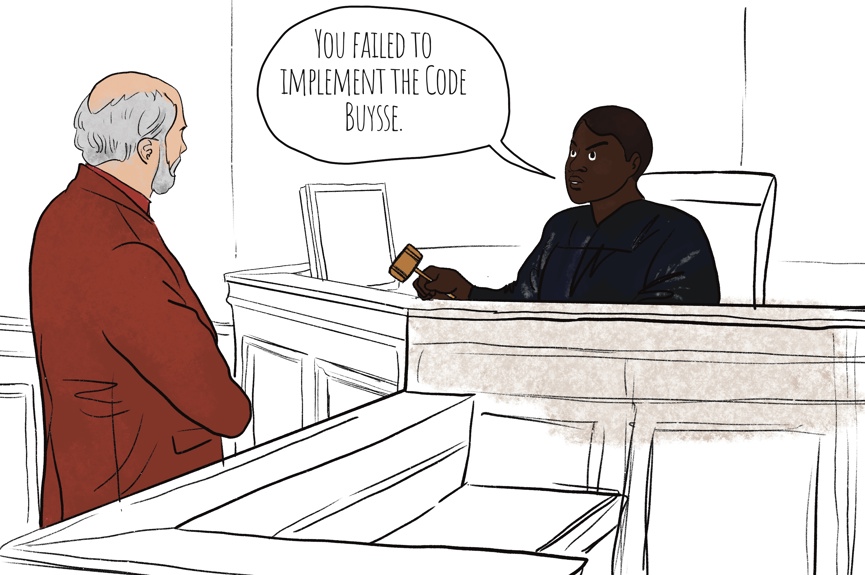

The Code Buysse is a soft law instrument, meaning that it is not legally enforceable as such. However, judges may take it into account, for example in the context of a dispute concerning directors' liability. Non-compliance with the Code Buysse can therefore, in certain cases, serve as an additional argument to demonstrate that a director has disregarded the company’s interests, which may constitute a ground for liability.

In other words, these are not binding rules that must always be applied, but rather recommendations that directors can voluntarily follow, and through which they can demonstrate that they are managing the company in a proper manner. This way, the code acts as a guide, while allowing enough room for flexible interpretation. Although the application of the code is not mandatory, its application is recommended.

3. Content en developments

The Code Buysse provides a framework for non-listed companies that aim for an efficient, effective, and future-oriented management. The code emphasizes the importance of good interaction between the company, the shareholder(s), the board, management, employees, and other stakeholders. Focus is also put on the importance of ESG-themes (‘environmental, social and governance’).

The new Code Buysse IV places greater emphasis on more complementarity and diversity in boards of directors in order to achieve better decision-making. It is recommended that when forming the governing body, individuals with diverse skills, backgrounds, experience, gender, and age are considered. Another new aspect is that a good director is expected to be able to allocate the necessary time for the board mandate, and therefore, an excessive number of mandates should be avoided. Furthermore, the Code Buysse IV highlights the importance of making timely arrangements for succession in family businesses in the event that the current generation is no longer able to continue.

The Code Buysse IV gives several best practices:

I. Long term vision:

- prioritizing the company's interests in every decision and giving precedence over the individual interests of shareholders, directors or managers;

- defining the company's mission and values;

- taking succession planning into consideration.

II. Legal corporate governance actors and their interaction:

- entrepreneurs are expected to be familiar with the rules of the Code of Companies and Associations regarding corporate governance actors (shareholders, the board of directors, and management);

- good communication between these actors is essential.

III. Sustainability and digitalisation:

- it is advisable that ESG helps shape both the strategy and organization of every company;

- corporate governance actors should remain informed well about topics such as artificial intelligence and digitalization.

4. Conclusion

The Code Buysse is a soft law instrument that provides recommendations about good corporate governance in non-listed companies.

Its application is not mandatory but is recommended to demonstrate that a board mandate is being exercised properly.

The new Code Buysse IV introduces several additional guidelines regarding, among others, diversity within the board, the importance of succession planning, and a long-term vision.