- Tax Law

- minimum tax for multinationals , Minimum tax , multinationals , multinational companies , large domestic groups , European Directive 2022/2523 , EU Directive 2022/2523 , benefits of profit shifting to jurisdictions with no or very low taxes , tax base , qualifying annual turnover , Qualified Domestic Top-up Tax , QDMTT , Income Inclusion Rule , IIR levy , Undertaxed Profit Rule , UTPR levy , domestic top-up tax , safe harbour , multinational enterprise group , MNE

On 31 December 2023, the law introducing a minimum tax for multinational companies and large domestic groups came into force.

This makes the minimum tax applicable from 2024 (financial years starting from 31 December 2023).

1. The broader framework

The introduction of this minimum tax results from the transposition of European Directive 2022/2523. This Directive, in turn, is the European translation of tax legislation developed by the OECD to ensure that multinational enterprises (MNEs) pay a fair share of tax wherever they operate (known as Pillar 2).

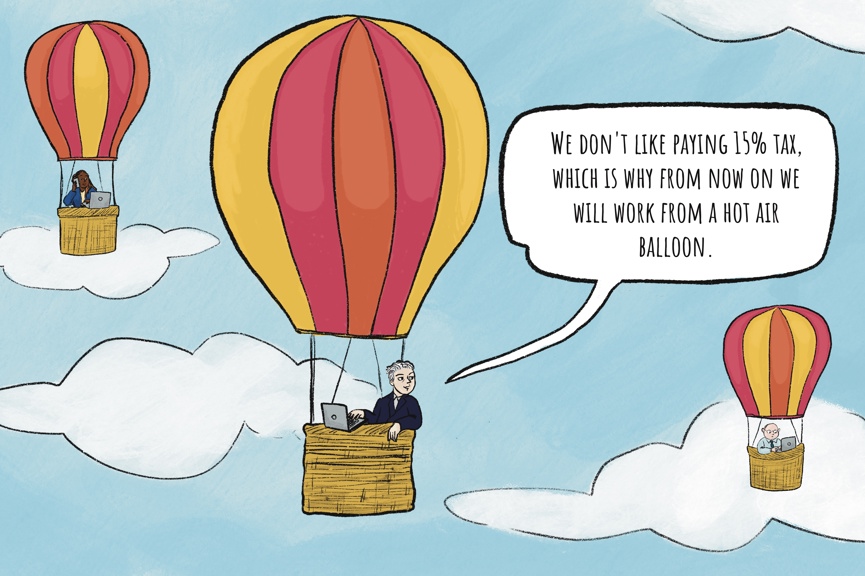

By removing a substantial part of the benefits of profit shifting to jurisdictions with no or very low taxes, the global minimum tax reform will level the playing field for companies worldwide and allow jurisdictions to better protect their tax bases.

2. Scope

The new law applies to Belgian companies belonging to a multinational group or to a sizeable domestic group with an annual turnover of at least EUR 750 million in the consolidated accounts of the ultimate parent entity. This annual turnover must have been achieved in at least two of the four most recent past financial years.

To calculate qualifying annual turnover, several adjustments will have to be made to the accounting net income or loss as shown in the financial statements.

The qualifying annual turnover is then used to determine the effective tax rate. If the effective tax rate is less than 15%, an additional levy will be due to achieve the targeted minimum tax.

Although the tax burden in Belgium will usually be higher than 15% (given the 25% tax rate), this will not always be the case due to a number of tax incentives (such as the investment deduction or the innovation deduction).

3. Realisation of the minimum tax

The minimum tax will be achieved through three different levy measures : the Qualified Domestic Top-up Tax (QDMTT), the Income Inclusion Rule or IIR levy and the Undertaxed Profit Rule or UTPR levy.

The domestic top-up tax (or QDMTT) allows a country to tax low-taxed entities on their territory up to 15%. In the absence of such domestic top-up tax, the country where the group's parent entity is located will be able to apply the IRR or UTPR tax.

Belgium introduced a domestic top-up tax (QDMTT) designed to qualify for the QDMTT Safe Harbour. On this basis, all low-taxed entities established in Belgium will be subject to this domestic top-up tax.

In the case of foreign group entities in one or more low-tax countries in which no (or insufficient) domestic withholding tax applies, Belgium will be able to levy the IIR withholding tax on behalf of the Belgian ultimate parent entity.

If foreign group entities in one or more low-taxed countries would escape both domestic withholding tax and IRR withholding tax, Belgium will be able to levy UTPR withholding tax on behalf of Belgian group entities.

4. Safe harbours

The introduction of the minimum tax will result in additional compliance and administration costs for both taxpayers and the tax administration. To mitigate these costs, a number of 'safe harbours' are provided for a multinational group to avoid calculating the effective tax rate and additional tax for its activities that are likely to be taxed at or above the minimum tax rate. If a proper safe harbour can be applied, no additional tax will be payable.

The new law provides for three (temporary) safe harbours running until financial years commencing up to and including 31 December 2026 :

A first safe harbour is that the jurisdictional surcharge is deemed to be zero where the multinational enterprise group (henceforth referred to as MNE group) has reported in its qualified country report a total revenue of less than EUR 10 million and has reported a profit (loss) before income tax of less than EUR 1 million in that jurisdiction.

A second sax safe harbour provides for a simplified way of calculating the effective tax rate, whereby if, according to that calculation, the effective tax rate exceeds a certain percentage, the jurisdictional surcharge is deemed to be zero.

A final safe harbour is that when the MNE group's profit (loss) before income tax in a jurisdiction is equal to, or less than, the amount of income excluded on the basis of substance, for group entities resident in that jurisdiction under the country report, the jurisdictional surcharge is deemed to be zero.

Meanwhile, the OECD has developed two additional safe harbours, one of which is permanent (QDMTT Safe Harbour) and one of which is temporary (UTPR Safe Harbour). These additional safe harbours are not yet included in the new law and will therefore have to be included in subsequent legislation.

The main safe harbour, being the permanent QDMTT Safe Harbour, means that it will no longer be necessary to carry out the complex calculation of the IIR surcharge or the UTPR surcharge if a Qualified Domestic Top-up Tax is applied in that country, which will mostly be the case.

The UTPR Safe Harbour can be applied by companies headquartered in a country with a profit tax of 20% or higher and appears to be tailored to US and Chinese companies. This will allow these companies to escape the minimum tax until 2026.

5. Formal obligations

Belgian companies falling within the above-mentioned scope will have to calculate their effective tax rate and file a return to the extent necessary.

A declaration on domestic withholding tax (QDMTT declaration) must be filed at the latest within 11 months after the closing of the financial year. Consequently, for the financial year ending 31 December 2024, a QDMTT declaration will have to be filed by 30 November 2025.

In principle, the IRR withholding tax and UTPR withholding tax (IRR/UTPR declaration) returns must be filed within 15 months of the close of the financial year. However, an extended deadline of 18 months is already provided for the first year.

The QDMTT declaration must be filed by the group entity established in Belgium or a local entity designated for that purpose. The IRR/UTPR declaration will only have to be filed by the group entities established in Belgium if a declaration has not already been filed abroad.

The various declarations will take the form of the model published by the OECD.

The system of advance payments as already applicable in corporate taxation will also apply to the minimum tax. Consequently, in case of insufficient advance payments, an increase will be due. Specifically in 2024, a tolerance will be provided on the basis of which all advance payments will be deemed to have been made during the first quarter.

To monitor the application of these new regulations, the tax administration will be able to apply the 10-year investigation and control period. In case of any infringements, administrative fines ranging from EUR 2,500.00 to EUR 250,000.00 may be imposed - in addition to the normal tax increases.

Would you like more information or assistance from the Seeds of Law specialists? Please do not hesitate to contact us at +32 (0)2 747 40 07 or at info@seeds.law.