- Tax Law

- tax regularization , part of the new government agreement , a (fifth) tax regularization round , confess and regularize tax sins , declare forgotten assets , foreign bank accounts , inheritance , donation , black or gray capital , repatriate this money to Belgium , fiscally non prescribed moveable income , underlying capital , high penalty rates

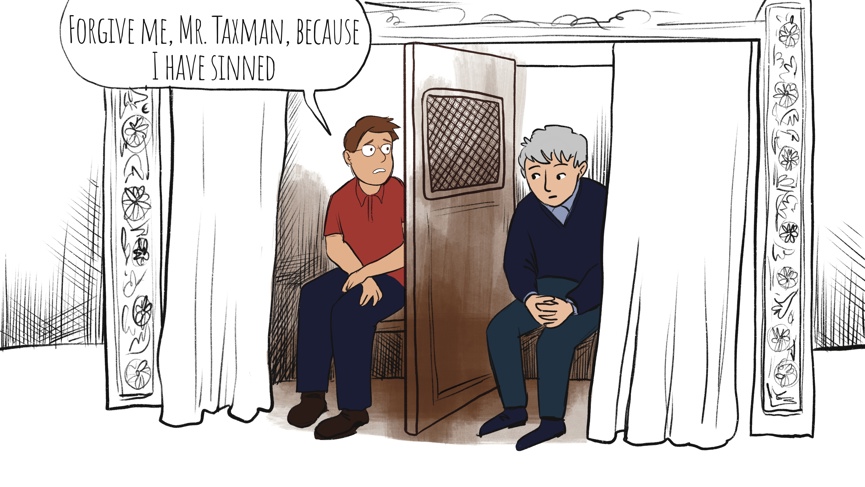

An important part of the new government agreement is dedicated to the introduction of a (fifth) tax regularization round.

The previous tax regularization round ended on 31 December 2023, and since then there was no possibility anymore to confess and regularize tax sins. Only at the level of the Flemish Region did it remain possible to declare forgotten assets (mostly foreign bank accounts) by means of a new inheritance tax return.

However, such regularization in the Flemish inheritance tax is often not sufficient to repatriate a foreign bank account with black or grey capital to Belgium. Indeed, following a circular letter from the National Bank of Belgium regarding the vigilance obligations imposed by the anti-money laundering legislation, Belgian banks take a very cautious attitude towards repatriations of funds from abroad.

As a result, many taxpayers who did not make maximum use of the previous regularization round currently find themselves in a stalemate.

If they (whether or not as a result of an inheritance or a donation) hold a foreign bank account with black or gray capital, they cannot repatriate this money to Belgium.

If they (or their legal predecessors) did repatriate such a bank account to Belgium in the past, only the fiscally non prescribed moveable income may have been regularized at the time. In that case, it may still have to be demonstrated to the Belgian bank today that the underlying capital has been subject to its normal tax regime. If this cannot be demonstrated, they may still be rejected by the Belgian bank.

In practice, it has long been argued that this situation is untenable. The introduction of a new tax regularization round is therefore very timely.

This new regularization round is part of a program law that would be put to a vote in Parliament at the end of March 2025 and is fully in line with the previous regularization round. However, penalty rates would increase by 5 percentage points except in cases of good faith.

There would be good faith in the situation of a gift or inheritance when the legal successor can prove that the gift or inheritance was made subject to the normal tax regime.

Specifically, therefore, a fiscally time-barred capital would be subject to a regularization tax of 45% (or 40% in the case of good faith).

The regularization levy for fiscally non-prescribed income would be recalculated by adding 30% to the normal tax rate (or 25% in the case of good faith). In the case of undeclared movable income, the regularization levy would reach 60% (or 55% in the case of good faith).

Those who find themselves in the stalemate mentioned above will probably eagerly take advantage of this new round of regularization. Of course, the criticisms of the previous regularization round remain valid, namely the heavy (and sometimes impossible) burden of proof regarding the origin of the underlying capital and the high penalty rates.

If you have any questions about this or if you would like assistance with the analysis of your file, you can always contact our tax specialists at Andersen in Belgium at +32 (0)2 747 40 07 or info@be.Andersen.com.