- Commercial and Economic Law

- influencer , social media marketing , influencer advertising , influencer marketing , marketing through influencers , professional influencer , published content , consumer protection , unfair practices , commercial post , non-commercial post , advertising , publicity , advertisement , advertiser , misleading advertising

In a previous article we were somewhat giggly about influencers but yet honesty compels us to say that influencer advertising and marketing is one of the fastest growing industries of the past decade. Companies have become aware of the huge impact influencers have on consumers. If you have teenagers of your own, you will no doubt have noticed this already.

What is often ignored, however, is that influencers must follow a lot of rules and that companies that use influencers can be held responsible for any violations committed by them.

Below, we outline the main rules and principles related to marketing through influencers.

1. Influencers are undertakings

Unlike France or Italy, for example, Belgium has no specific legislation regarding influencers or social media marketing. The question therefore arises as to which rules influencers must comply with in Belgium.

According to Belgian (and European) law, influencers are considered "an undertaking" when they advertise or sell products on a regular basis and receive remuneration for doing so.

Beware, this does not require 'influencing' or 'social media content creation' to be your full-time job. It is sufficient that you do this with some regularity.

Nor is it necessary for the compensation to consist of 'money'. Other benefits the influencer receives from its commercial partners, such as discounts, gifts, free goods or invitations to events, are also considered 'compensation'.

In the absence of specific legislation on influencers in Belgium, these 'professional influencers' must abide by the same rules as any other undertaking. However, for influencers, specific interpretation of these rules should be made on a regular basis.

2. Tax and formal obligations as an undertaking

An influencer that qualifies as an 'undertaking' must - like any other undertaking - be registered with the Crossroads Bank for Enterprises (CBE) and have a company number.

If necessary, this number will also count as a VAT number. Indeed, as an undertaking, the influencer will have to comply with VAT legislation. We do point out that as a so-called 'small business' with a maximum annual turnover of €25,000 excluding VAT, you are eligible for a VAT exemption.

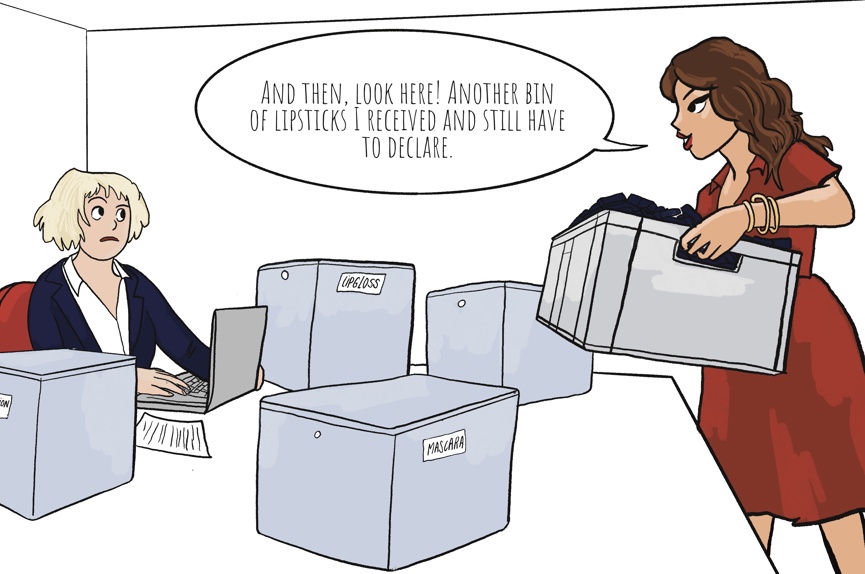

Either way, as an undertaking, you will have to issue invoices to your clients and declare your income and pay taxes on it. The latter also applies to so-called benefits in kind such as discounts, gifts, free goods or invitations to events you may receive as an influencer. The value of these benefits is also income and must therefore also be declared as part of your tax return.

In addition to these tax obligations, every professional influencer - like any other undertaking - must also disclose his/her business details. This means that an influencer must disclose his/her legal business details on his/her social media pages and website(s). This includes name, company number, business address and an email address.

The influencer may fulfil this obligation by referring to his/her website on his/her social media channels. In this case, the influencer must include his/her company details on this website and ensure that it is easily, directly and permanently available to the public. This can be at the bottom of the website or in an appropriate section (e.g. on the contact page).

Many influencers work from home and their business address is also their private address. If they want to avoid their private address being made public, they can use the services of a recognized business center and open/register a second 'branch' with that business center. They can then register one branch at the home address and one branch at the address of the approved business center with the address of the second branch at the approved business center being communicated on the website(s) and social media pages as the 'business address' instead of the private address.

3. Obligations in the context of published content

As mentioned above, influencers should follow the same rules as all other undertakings.

Influencers must also ensure, in the context of their social media content, that they respect the rules on consumer protection and unfair commercial practices.

We summarise below the main rules specific to influencers.

Influencers often combine commercial with non-commercial posts. Users may thus think that a particular post reflects the influencer's own opinion about a product, when in fact the influencer is paid to promote this product. Thus, the commercial nature of posts is not always clear and may therefore mislead consumers. Such can thus be considered an unfair market practice. Consequently, it should be clear to consumers when influencers are advertising and when they are not.

Since commercial posts are considered advertising, influencers should disclose the commercial nature of these posts. Economic Inspection applies the following rules regarding this mandatory disclosure:

- The post must be "tagged" with an unambiguous word that is clear to everyone, such as "advertising", "publicity", "advertisement", ...;

- This tag should also be immediately visible to the follower without having to open the post and should not be placed at the end of the post between different hashtags or as the last hashtag. The tag should preferably appear at the front of the message or on the photo or video. The tag should be clear and not disappear into the background, there should be sufficient contrast (in terms of color and font) with the background;

- The tag should be in the same language as the message;

- Tags like "collaboration", "sponsored", "partner", "ambassador", "courtesy of", "commissioned by" and abbreviations like "pub", "adv" are not considered sufficiently clear;

- The tag "sponsored" can only be used if:

- (1) there is no agreement with the brand/company and it has no expectations about the number or content of the posts,

- (2) there is no contract regarding the post and

- (3) the influencer does not receive a commission based on the number of clicks.

Even if your post is sponsored, you should still use the tags "advertising", "ad" or "publicity" if that better reflects the content or commercial nature of your post and is clearer to the target audience.

- The brand or company being advertised should be tagged or clearly stated.

It is also advised - if available - to use the labels provided by the platforms themselves, such as Instagram's "Paid partnership" label and YouTube's "Contains paid promotion" label.

A post is considered a "commercial post" and therefore advertising when the influencer receives compensation for this post. We hereby reiterate what we have already mentioned above regarding compensation, which does not have to consist of money but can just as easily consist of a discount, free goods or other gifts.

Nor does it matter whether there is an actual agreement between the influencer and the company to qualify a post as advertising.

4. To what extent are advertisers responsible?

Just because the social media content is created and published by the influencer does not mean that the company for whom it is advertised cannot be held responsible for its content.

When companies contract with influencers, they have a responsibility to ensure that the content of the social media content complies with the provisions relating to unfair market practices and misleading advertising. The president of the Enterprise Court of Antwerp has already ruled that even if a company leaves the initiative and creation of the advertising to a third party, e.g. an influencer, that company still remains responsible for the content of this advertising.

Thus, when a company uses the services of an influencer to advertise and publish for it, the company may be held liable for a breach by the influencer of the provisions on unfair market practices and consumer law.

We therefore recommend that companies using influencers develop a written policy for advertising on social media and ensure that influencers used by the company comply with and respect this policy.

Do not hesitate in contacting our specialists should you have questions about this item: +32 (0)2 747 40 07 or info@be.Andersen.com.